bexar county tax office pay online

You can search for any account whose property taxes are collected by the Bexar County Tax Office. Resources and searches to help you find the information you need.

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Nice and clean yes security nice and tight lol overall not too bad nice building too lol.

. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. Search accounts whose taxes are collected by Bexar County for overpayments. Bexar County Tax Assessor-Collector Office P.

Online portals to make certain types of payments. Please follow the instructions below. Karnes City Texas 78118.

Or you may pay online at. Quarter payments must be set-up by January 31 2022. Click here to register online on TxDMV website.

This County Tax Office works in partnership with our Vehicle Titles and Registration Division. Opening Your Portfolio Begin a New Search. This service only accepts credit or debit cards and there will be a convenience fee added to the payment amount charged by Official Payments.

When using the online property tax payment option there is a 100 fee for all e-checks and a 219 fee for all credit card transactions. To pay your Ad Valorem taxes by phone please call. Pay all fines andor fees to the court by mail or in person.

According to the tax assessor-collector office Bexar County has the third highest number of homes getting assistance in the state. After locating the account you can also register to receive certified statements by e-mail. Please allow up to 15 days for the processing of your new window sticker or new plates by mail.

Other locations may be available. Payments made online and by phone may take up to 48 hours to reach our office. The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH.

2 days ago Feb 20 2022 Workstations with internet access are available if needed to view job postings and apply online at 211 S Flores San Antonio TX 78204 8am -. 14 reviews of Bexar County Tax Assessor-Collector Yes Tracie was very professional and took care of all paper work no watting. Albert Uresti MPA Physical Address.

Box 1457 Kingsville Texas 78364 361-595-8541 Motor Vehicles 361-595-8542 Property Tax. Box 839950 San Antonio TX 78283-3950 Telephone. Enter an account number owners name last name first address CAD reference number then select a Search By option.

Reports Record Searches. Our office is committed to providing the best customer service possible for all our citizens. Each portfolio may consist of one or more properties and includes pertinent tax information such as property location certified owner and current year and total.

Request to take a driving safety course and pay the court costs of 137 or 162 on offenses committed in school zone. All taxes are due by January 31 2022. The vendor fees associated with credit card transactions and e-checks are passed along to the credit card or e-check users and are not paid by the Williamson County budget.

Payments may be mailed. Online Credit Card Payments. Property Tax Payments Online.

Click on Property Search. The 80 million in the federal Homeowners Assistance Fund is paid out by the state. There is a convenience charge of 210 added by JetPay to cover the processing cost.

Tax statements are in the mail. Our office is responsible for over 14 million vehicle registrations per year and for collecting over 25 billion in taxes in a fair and equitable manner. Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online network.

Maria Victoria Valadez P. Account Assistant - Tax Office - Job in Bexar County. For convenience Taxpayers can now request to receive their Property Tax Statement via email.

Thank you for visiting the Bexar County ePayment Network. To pay with a major credit card you must have your 12 digit tax account number and your credit card number. After locating the account you can pay online by credit card or eCheck.

All DSC qualifications referenced above must be met Submit proof of valid insurance at time of the offense for dismissal at no cost. Please contact your county tax office or visit their Web site to find the office closest to you. Pay your property taxes online.

If you havent received your statements please call and request another statement or make a payment on the phone. Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. Acceptable forms of payment vary by county.

The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Resources and request portals for Bexar County Information. You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

Bexar County Tax Assessor-Collector Albert Uresti told county commissioners Tuesday that eligible property taxpayers behind on their payments can apply for assistance but accessing the application is difficult for some residents. Please select the type of payment you are interested in making from the options below. 233 N Pecos La Trinidad San Antonio TX 78207 Mailing Address.

Box 839950 San Antonio TX 78283-3950. Search for any account whose property taxes are. Thank you for visiting the.

Search Property Tax Overpayments. Search for records and reports of various types. Pay Property Taxes Online at.

You can search for any account whose property taxes are collected by the Bexar County Tax Office. Credit card payments may be paid through JetPay the authorized agent of the Bexar County Tax Assessor-Collector.

Attorney For Dismissed Bexar County Democratic Party Precinct Chairs Says Judge Has Cleared Their Return San Antonio News San Antonio San Antonio Current

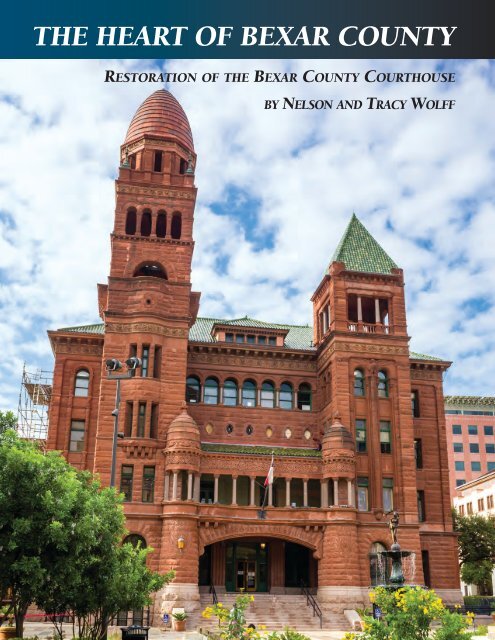

Everything You Need To Know About Bexar County Property Tax

Bexar County Tax Office West Side 8 Tips From 506 Visitors

Bexar County Property Tax Deadline Looming Tpr

Payments Bexar County Tx Official Website

Real Property Land Records Bexar County Tx Official Website

Bexar County Jail Detained A Man For Five Extra Months There S No Clear Answer To Why Texas Standard

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

Bexar County Property Tax Loans Ovation Lending

News Flash Bexar County Tx Civicengage

Property Tax Information Bexar County Tx Official Website

Everything You Need To Know About Bexar County Property Tax

Bexar County Delinquent Property Taxes Find Out About Bexar County Property Tax Rates More Tax Ease